You can now stack remortgage deals on Stacked, in order to better understand the pros and cons of remortgaging properties within your portfolio.

Disclaimer. Nothing contained in this article, is to be construed as financial advice. Stacked is an unregulated platform and our team members are not qualified to offer financial advice.

Problem

When making any strategic decision about the best way to manage and grow your property investment business, it is essential that you have all the right information at your disposal, so that you’re able to make informed and well considered decisions.

For example, you may be thinking about releasing equity from a property, so that you can buy and develop another property, in order to increase your monthly cash flow.

Before doing so, you should consider not only the opportunities but also the risks, associated with any particular course of action.

Solution

You can now stack remortgage deals for any property within your portfolio on Stacked.

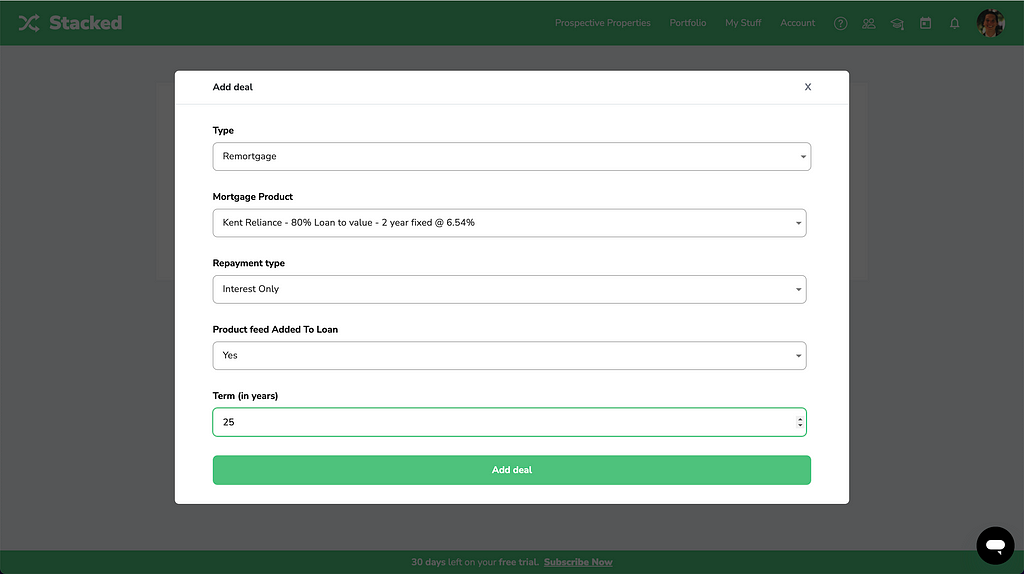

When doing so, you will be prompted to select:

- A suitable mortgage product

- Whether you will opt for a repayment or interest only mortgage

- Whether you plan to add the product fees to the loan

- The term of the mortgage

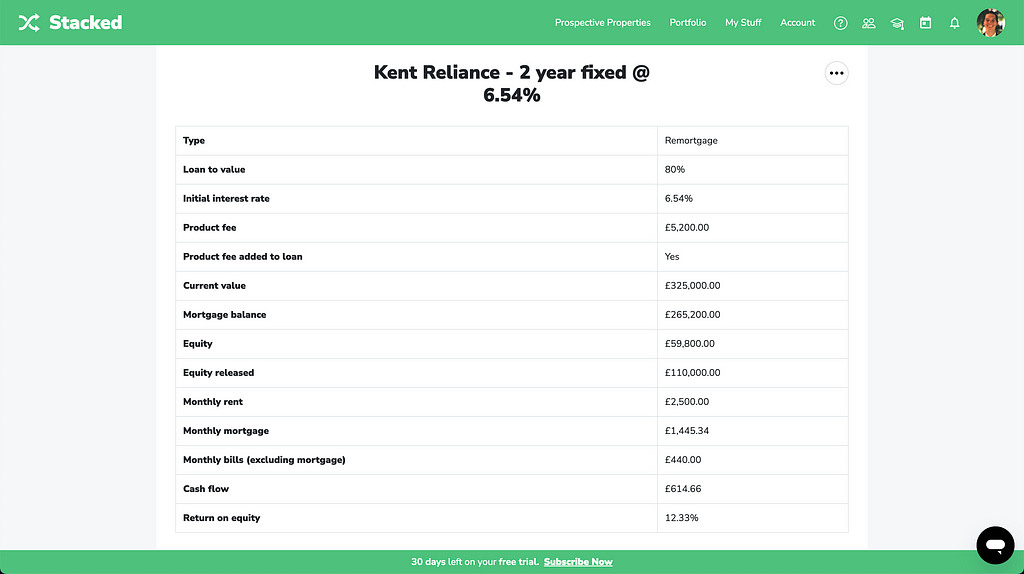

Having done so, you will be able to review lots of useful information about how your property will perform, once you have remortgaged to the new product.

This schedule of information includes:

- Loan to value

- The interest rate of the new mortgage product

- Product fee

- Whether you will be adding the product fee to the loan

- The current value of your property

- The balance of your mortgage, once you have remortgaged

- The amount of equity you will have in your property, once you have remortgaged

- The amount of equity you will release from the property, as part of the remortgage process

- The monthly rent you are generating from the property

- Your monthly mortgage payment, once you have remortgaged

- Your monthly operating costs, excluding your mortgage payments

- Your monthly cash flow, once you have remortgaged

- Your return on equity, once you have remortgaged

Summary

With all this information at your disposal, you will be able to make more informed and well considered decisions, as to whether remortgaging is in your best interests.