Build a systemised

property investment business

1. Stack the deal

Say goodbye to spreadsheets

The Stacked journey begins, once you have identified a property that you wish to add to your portfolio.

To determine whether this is a good idea, you will need to do two things:

Conduct Your Due Diligence

By integrating directly with popular technologies and databases, Stacked makes it very quick and easy for you to conduct your due diligence.

For example, you can use:

- Google Maps to research the local area

- The Energy Performance Certificate database to quickly identify the type, size and energy efficiency of the property

- Land Registry to quickly find comparable properties, so you can determine the value of the property on a cost per square metre basis

You can also:

- Capture information about the current owners of the property

- Store photos and videos of the property

- Store key documents, such as architectural drawings and property searches

- Manually add as many rent and sale comparables, as you like

Decide On Deal Structure

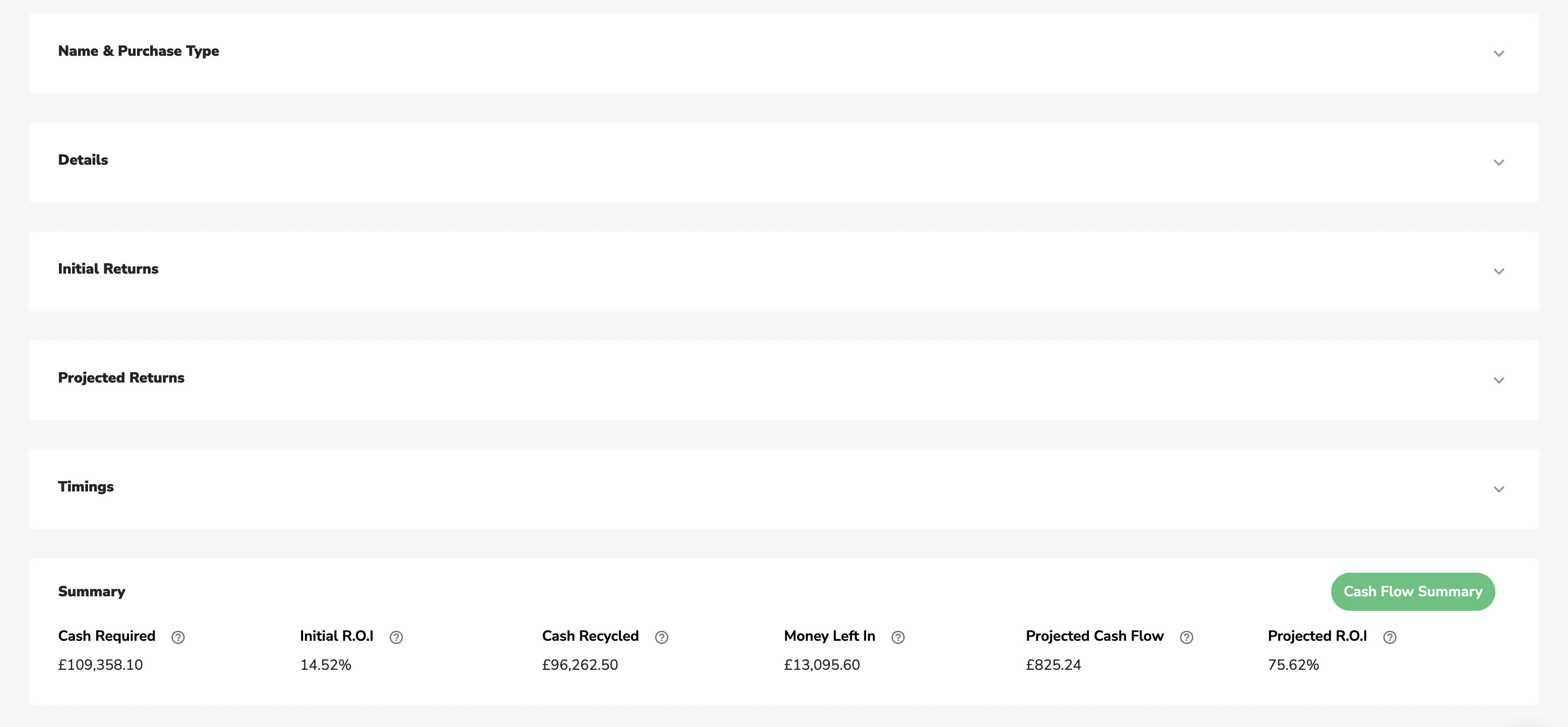

Once you have compiled all this information about the property, it is time to start stacking deals, in order to decide on the best way of structuring things.

For any given property, you can stack as many deals as you like, using the following strategies:

- Single let

- house in multiple occupation (HMO)

- Multi-Dwelling

- Flip

After doing so, you will be able to compare the relative pros and cons of each strategy, so you can decide upon a deal structure that best suits your aims and personal circumstances.

For example, creating an HMO may produce the highest monthly cash flow and return on investment but you may prefer to structure the deal as a Single let instead, on account of the lower risk profile and reduced management overhead.

2. Raise the money

Leverage public and private funds

It is now time to raise the money you need, to make this deal happen.

This comes in two forms:

Public Money

This typically takes the form of mortgages and bridging loans.

You can add an unlimited number of mortgage and bridging loan products to your stacked account.

When stacking your deals, you can choose which products to use, for the purpose of acquiring, developing and re-financing your property. For example, a common approach is to use a bridging loan to acquire and develop a property, before switching to a traditional mortgage once the property has been renovated and rented out.

There are numerous ways of structuring a deal. Stacked is designed to help you make decisions, which support your personal aims and circumstances.

Private Money

When stacking any deal on the platform, you will see the total amount of cash required to make a deal happen. This is on top of any public finance, which you are planning to use.

No matter how much cash you have, there will inevitably come a time when you run out. At this point, you will need to think about raising private money.

To do so successfully and sustainably, you will need to:

Find Private Investors

There are many different ways to find private investors. Here are just a few options, which you may wish to explore:

- Friends and family

- Networking events

- Family offices

- Social media

Your job is to build your personal brand, so as to attract the attention of private investors, who may wish to invest with you.

At the time of writing, our engineering team is actively developing a new set of fundraising features, which will allow you to publish deals on Stacked, so they can be seen by our growing community of private investors.

Stay tuned for further announcements on when you will be able to take advantage of these platform improvements.

Secure Private Investment

Finding private investors is only part of the challenge.

Once you have captured their attention, you will need to persuade them that investing with you, is a safe and sensible idea.

To set the stage and start building trust with your prospective investors, you should share a Company Executive Summary with them.

This will provide an overview of:

- Your company's mission and core values

- A detailed bio for each of your team members, along with their relevant skills and experience

- Detailed examples of the previous projects, along with examples of key challenges you faced and how you overcame them

- Testimonials and reviews from other private investors you have worked with

The Company Executive Summary should be shared with your prospective investors, prior to discussing any specific deals.

This is because it will give the investor a welcomed chance to learn more about you and your company, so they can decide whether to continue the conversation.

There are many reasons why they may not want to do so and if that is their wish, you should respect it and not take it personally.

For example, your company may be focussed on delivering HMO's in London, whereas the investor is looking to invest in Single lets in Yorkshire. We all have different requirements and they are not always going to be aligned.

Another key reason for sharing a Company Executive Summary before discussing any specific deals, is because you do not want to make your prospective investors feel rushed or pressured. Think about it this way .... would you ask someone to marry you on the first date?

Once you have shared your Company Executive Summary and your private investor has expressed interest in exploring things further, you will have set the stage for sharing information about specific deals, which match their criteria.

You also need to ensure you meet all your legal obligations, with regards to verifying any prospective investors are qualified to receive investment opportunities from you. You should refer to the Financial Conduct Authority for relevant news and updates, in this ever changing regulatory landscape.

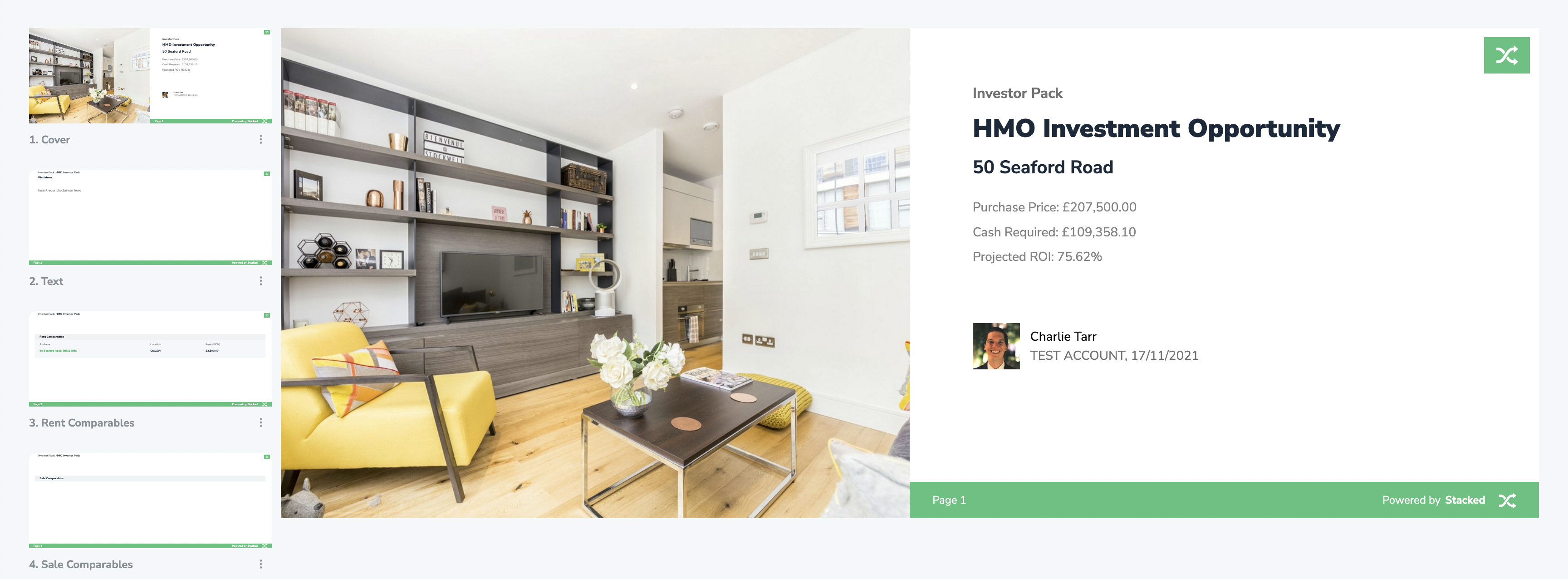

Stacked will support your efforts to secure private investment in a few different ways.

You can automatically generate investor packs for any deal, which you have stacked on the platform. Having done so, you can share these with your private investors for their consideration.

At the time of writing, our engineering team is actively developing a new set of fundraising features, which will enable you to:

- Build a profile for your company and all of your team members

- Generate presentations for all of your existing properties, which will showcase your track record of previous projects

- Automatically generate a Company Executive Summary, which includes all this information. This will be automatically updated, whenever you add new team members or properties to your portfolio.

Stay tuned for further announcements. We're continuously improving the platform and adding new features, which will support your efforts to build a systemised property investment business.

3. Buy the property

Say hello to workflows

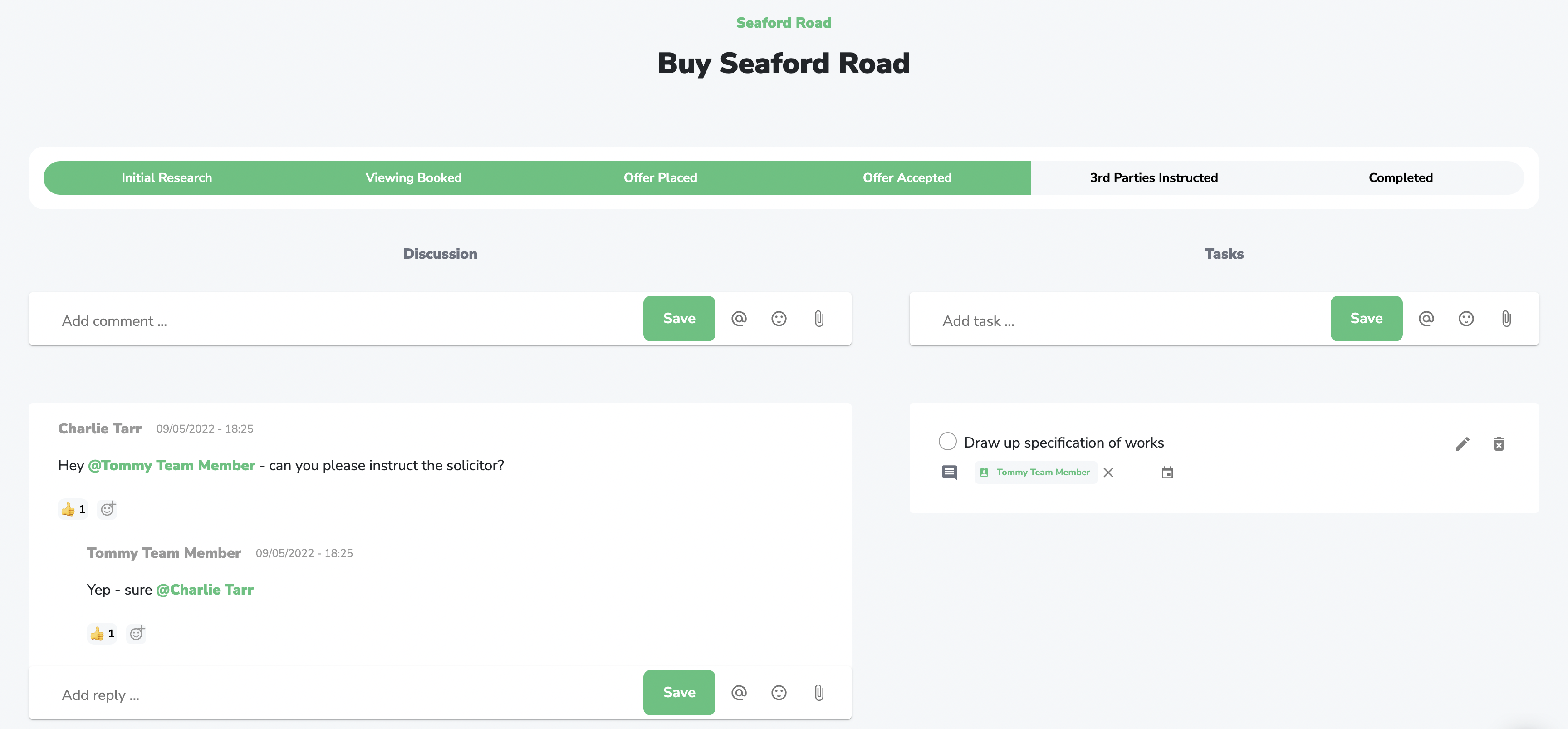

It is now time to work through the process of buying the property.

This is where the power of Workflows start to express themselves.

When buying a property, you are not doing just one thing, you are doing many things concurrently. For example, you will be:

- Working through the conveyancing process with your solicitor

- Working through a finance application with your mortgage broker

- Planning a renovation project with your builder and architect

- Liaising with your private investors and internal team members

For each of these processes, you will be able to create a dedicated Workflow, which will allow you to:

- Track the progress, against a pre-defined set of pipeline stages

- Handle all communication with your own team members, extended power team members and external 3rd parties

Workflows on Stacked are extremely dynamic and powerful. Not only will you benefit from streamlined communication and process management, across a dispersed group of individuals, you can also tap into powerful opportunities for permission based information sharing.

For example, you will be able to progress mortgage applications directly on the platform, by automatically sharing the following information with your chosen mortgage broker:

- Details about the property you are buying

- Details about the way the deal is to be structured

- Relevant information about your existing portfolio, such as assets, liabilities, companies and individual team members

This will dramatically reduce the amount of information you will need to manually share with your broker, as they will have access to everything they need, without needing to ask you for it.

At the time of writing, we are in the beta release phase of running mortgage applications directly through the platform. Please contact us, if you wish to join the beta programme and gain early access to this feature.

As with every other aspect of the platform, we are continuously improving things, so remember to stay tuned for announcements.

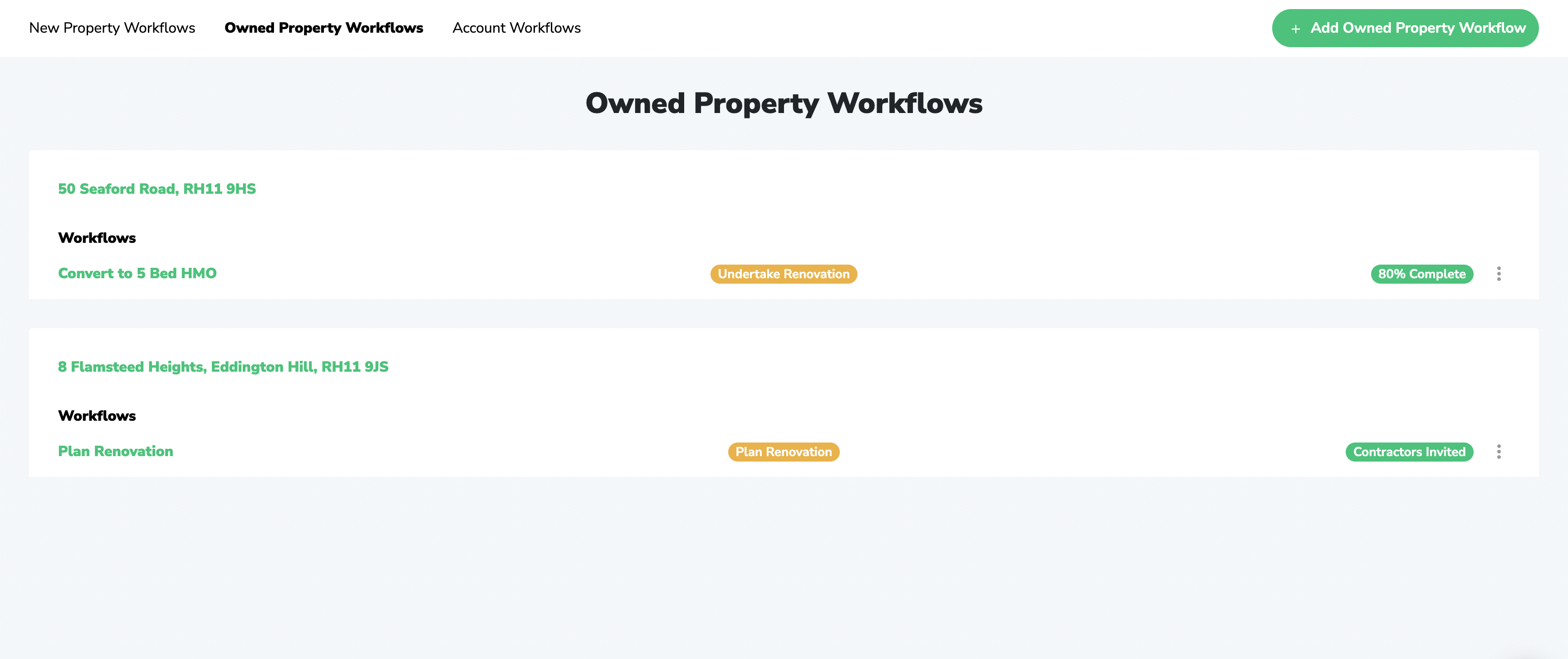

4. Add value

Plan and manage developments

There are many different ways to add value to a project. To name just a few, you can:

- Obtain planning permission for a change of use

- Split a freehold property into multiple smaller dwellings, with individual leases

- Renovate the property to a higher standard

- Create new dwellings on the same plot of land

Whatever you're planning to do, you can utilise our workflows, for the purpose of progressing things and handling all communication with the relevant parties.

5. Recycle money

Directly on the platform

Whether through re-finance or sale, in order to scale your property investment business, as quickly as possible, it will be necessary to recycle funds for use in future projects.

As with the process of raising money, you will be able to progress any relevant finance applications directly on Stacked, using our dedicated workflows.

This will greatly simplify the remortgage or further advance process and help you to stay organised, as you scale up and the number of concurrent processes begin to compound.

6. Manage and repeat

With full portfolio management

As mentioned at the start of the guide, the goal is to spin the Stacked Flywheel as frequently and quickly as possible.

As you do this successfully, the number of properties, tenants and team members will start to grow.

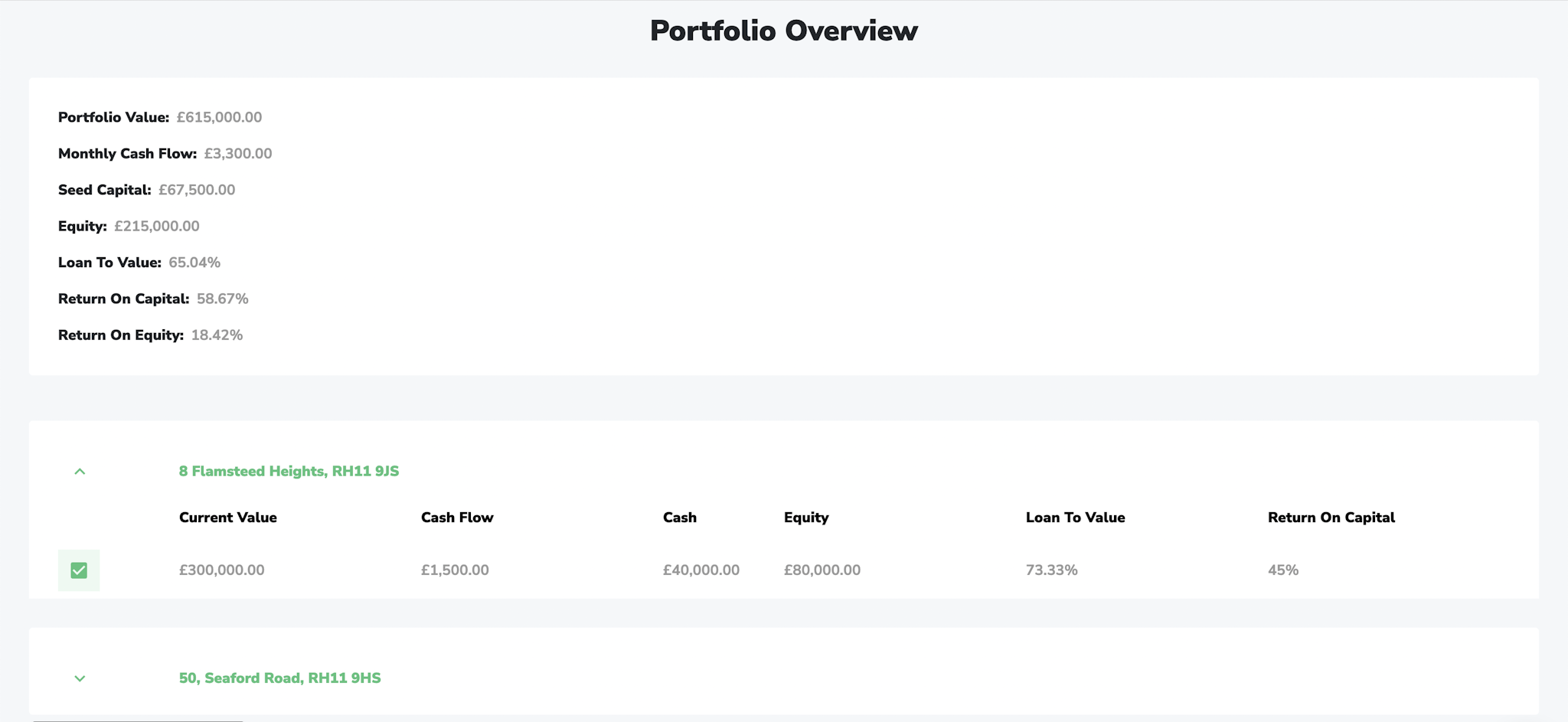

As your property investment business scales, the benefits of the Stacked platform will compound.

Everything will remain extremely well organised, so you can continue to focus your energies on growth, rather than developing new systems to manage a larger organisation.

We have portfolio management capabilities built directly into the platform, so you will not need to go in search of additional technologies to support the growth of your portfolio. From managing tenancies to dealing with maintenance issues, we've you got you covered.